Today, we're doing an InDesign tutorial on how to create a webinar worksheet. Now, I'm going to go over the four main components I think you need to think about when you're delivering your webinar worksheet. Then, we're going to create one together in InDesign. Hi everyone, I'm Lisa from Pretty Fabulous, and I help online businesses create beautiful digital downloads using InDesign. If this sounds like something you might be interested in, make sure to hit the subscribe button below. I post new videos every Monday and Thursday, and I do trainings on Saturdays. Here is the webinar worksheet that we will be creating together today. Now, you have the logo, the title, the who, when, and where, and you have four questions with fill in the blanks, as well as a call to action and a deadline at the bottom. We can get really fancy with checklists and infographics, but that's really for the Incredible Workbooks course. If you are interested in that, I will leave information below. But just for today's lesson, we're going to create a simple text-based webinar worksheet. So, let's go ahead and go over here to the top, to File > New Document. We're going to make this an 8.5 by 11 portrait and we're going to put 5.5 inch margins all around. I think that having a 1 inch margin is a little weird-looking for a webinar worksheet because people probably aren't going to be 3-hole punching it. Alright, so first, let's create these two blocks up here at the top. We're going to go over here to the rectangle tool and we're simply going to drag and drop rectangles. Nothing too difficult. I'm going to color this in pink. Then, I'm going to go over here to the selection tool. I'm going to copy...

Award-winning PDF software

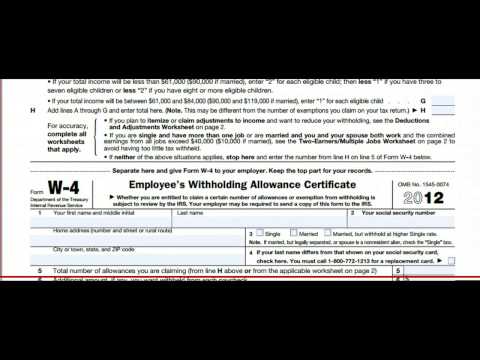

Fillable W-9 Form: What You Should Know

These tax forms may be used as a guide to fill out your next tax return. For more information, go to , then go to the Forms and Taxes tab. To use the online version of the Free File Fillable Forms, go to “Fillable Forms” in the left navigation pane. Free File Fillable Forms Free File Fillable Form. (October 2018). Department of the Treasury. Internal Revenue Service. Free File Electronic Fillable Forms for a Tax Form (PDF). Filing the Free File Fillable form at, you can complete a Free File form and mail it electronically to one of the following addresses by April 2018. Taxpayers outside the United States can use an address on file with the IRS to file a Free File return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Fillable W-9, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Fillable W-9 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Fillable W-9 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Fillable W-9 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form Fillable W-9