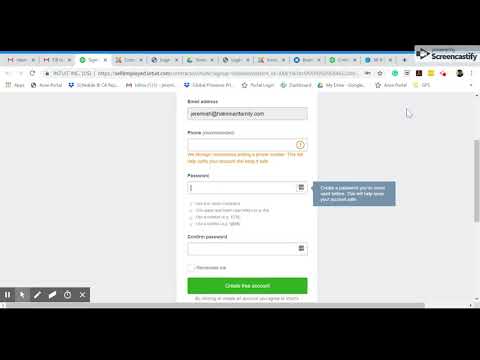

True." Hey guys, so today we're going to be talking about how to fill out your W-9 info with QuickBooks. As you can see here, we already have a W-9 tutorial video and sample, and that should be pretty useful for you. But in this video, we're going to be talking about how to give us your info in this online application. So, after filling out your W-9 request form, you should have received an email that looks exactly like this. It's pretty straightforward. You're just going to press the "Enter W-9 info" green button, and after that, you're going to be taken to this page right here. Your email address is already going to be filled in, and that's not going to change. All that's left for you to do is to fill out the required information. We do recommend that you give us your phone number so that it's easier to contact you. Also, make sure to create a strong password to prevent any potential hacks. Okay, so now you should be taken to this page where you will be entering your new info. You will be able to decide how you file taxes, and most people do file with Social Security numbers. A select few do file using an employer identification number, but that's rare. Your best bet is to go with the Social Security number option. Now, you're going to be providing all the personal information which includes your tax ID. We do require this information, as well as your legal name and address. Please make sure that all this information is accurate and legible so that we can use it for your tax purposes. The next step in your QuickBooks enrollment is to basically fill up this document. All you have to do is sign at the bottom, and...

Award-winning PDF software

Form Fillable W-9 online NV: What You Should Know

You are even able to view and print the state tax records you have filed. Tax Account Access for Nevada Residents — Online Account (in Nevada) × Nevada requires you to login and select an account type to access your tax filings and tax records by. A tax account can be a home office tax account, an LLC tax account, a joint account, an individual account, or a corporation tax account. Tax Account Access for Nonresidents A Nevada Tax Account can be a Nevada resident tax account, a nonresident tax account, or a corporate tax account for a Nevada corporation or LLC. Tax Account Login for Nevada Residents — Account Type (In Nevada) × A Nevada resident tax account is defined as: A taxpayer who filed a return and claimed an itemized deduction for his or her state, local (city) & federal income taxes (or a spouse or dependent). Nevada resident tax account means a tax account for a Nevada resident who has filed a tax return and claimed an itemized deduction for state, local (city) and federal income taxes (or a spouse or dependent). If a Tax Account is not a Nevada resident, it is not able to register for an online tax account. A Nevada resident must have a Nevada state identification number (ITIN). Nevada Tax Account Login for Nonresidents — Account Types (In Nevada) × Nevada nonresident tax account means a tax account for a Nevada nonresident who does not have a Nevada state identification number or ITIN and whose filing status does not permit payment for his or her state, local (city) and federal income taxes (or a spouse or dependent). A Nevada nonresident tax account means a tax account for a Nevada nonresident who has filed a tax return and claimed an itemized deduction for his or her federal income taxes in the previous calendar year. How to Open a Nevada Tax Account Online The process of opening a Nevada tax account with the Department of Taxation uses the same information as for filing your return online. A Nevada resident would need to file a Nevada individual, LLC, or corporation tax return and obtain and file an ITIN, if applicable. An LLC tax refund will be issued only if the IRS receives payment for the LLC tax liability or loss. Please see the Information to Prepare a Nevada Individual Tax Return page for more information.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Fillable W-9 online NV, keep away from glitches and furnish it inside a timely method:

How to complete a Form Fillable W-9 online NV?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Fillable W-9 online NV aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Fillable W-9 online NV from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.

Video instructions and help with filling out and completing Form Fillable W-9